nr4 and nr7 trading strategy in Intraday with inside bar formation and ORB trusted trading

Inside Bar 9. Outside Bar 10. NR7 Learn more: Price Action Trading Resource Guide 1. Reversal Bar Pattern What does it look like? A bullish reversal bar pattern goes below the low of the previous bar before closing higher. A bearish reversal bar pattern goes above the high of the last bar before closing lower. What does it mean?

BANK NIFTY nr7 day and inside bar. for NSEBANKNIFTY by bijoy2526 — TradingView India

Address: Champ de Mars, 5 Avenue Anatole France, 75007 Paris, France. Phone: +33 892 70 12 39. Website. "It's on many visitors' must-see lists, but the Eiffel Tower is often viewed as a victim.

nr4 and nr7 trading strategy in Intraday with inside bar formation and ORB trusted trading

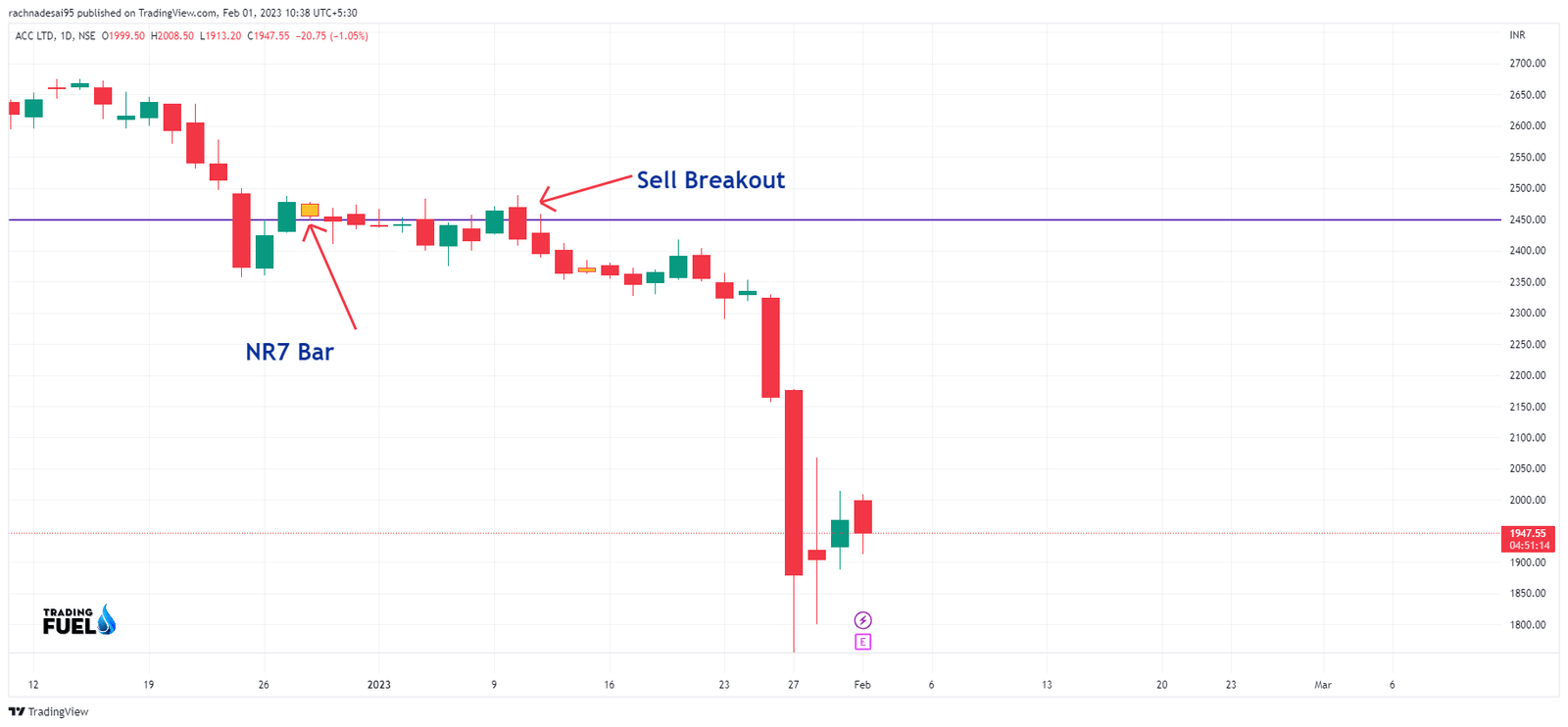

The closest valley or peak before the NR7 is where the trend began. The closest peak or valley after the NR7 is where the trend ended. I compared the peak or valley to the average of the highest high and lowest low price of the NR7 pattern. The 5-bar peak or valley number tends to find major turning points on the daily charts.

NR7 Trading Strategy (How To Trade The Narrow Range 7 Bar) Forex Trading Strategies

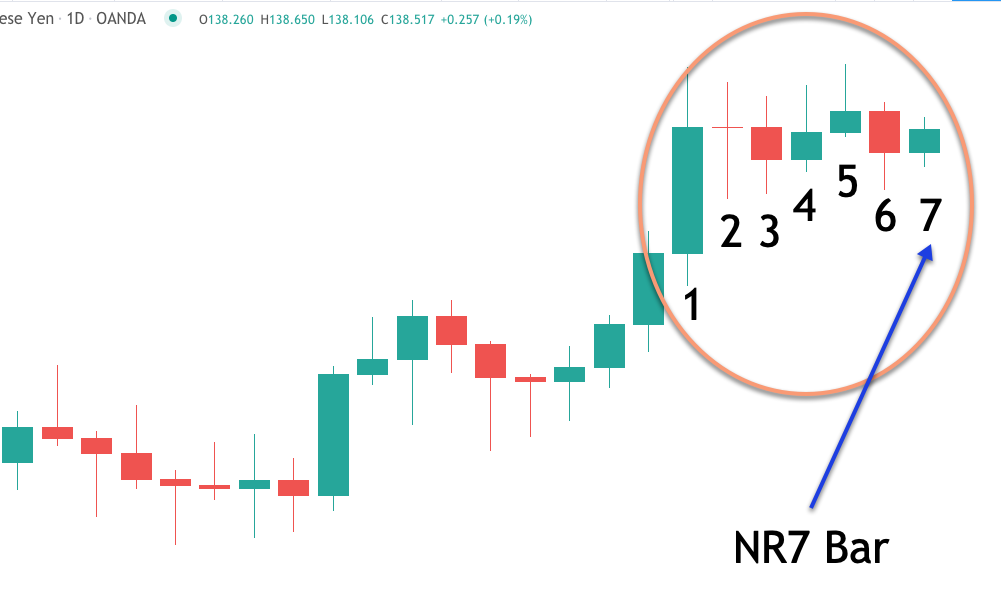

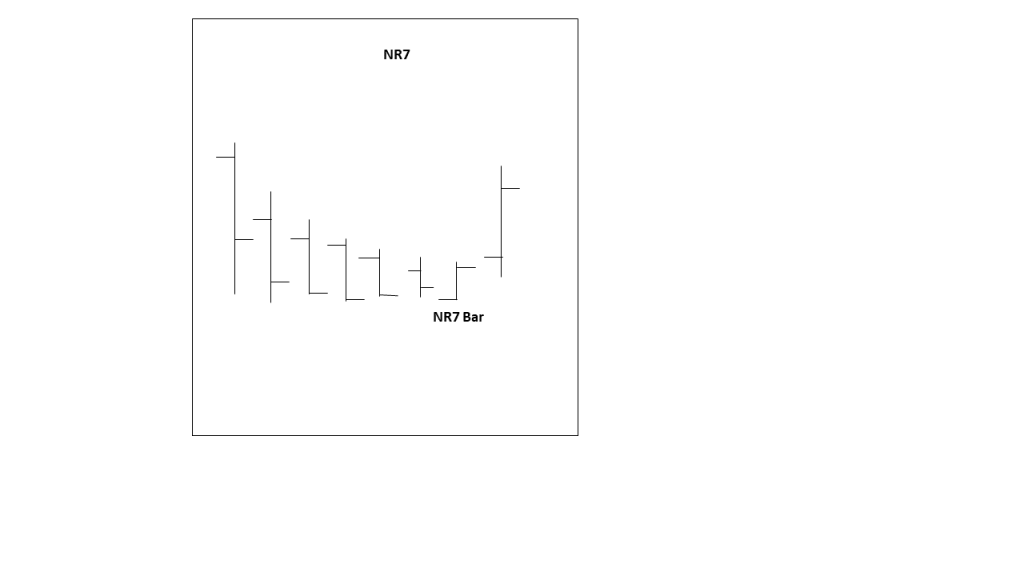

All What Is The NR7 Pattern? What is the NR7 pattern? The NR7 pattern is the narrowest range bar (or candlestick) in 7 days. The NR7 pattern is made of of 7 bars. The 7 bar will have a range that is much smaller than the previous six candlesticks. A range is defined as the difference between the high price and the low price. What Is The NR7 Day?

Inside Bar and NR7 for NSEIDEA by Dinesh12323545 — TradingView India

21404.95 (0.53%) F&O Cash NR4 NR7 Stock Screener NR4/NR7 Live screener lists down stocks that were in NR breakout list end of day and have crossed High or Low of NR candle in live market. Kindly note that you need to understand NR7-NR4 strategy befor using this screener. Read more Export CSV End of the Day Live Breakouts Symbol Ltp OI NR9 NR7 NR4

Nr7 — インジケーターとシグナル — TradingView

NR5 and NR7 Inside Bar Trading Guide Learn To Trade The Inside Day NR5 + NR7 Bars An inside bar and narrow range bars are examples of volatility contractions in the market. We can consider these a period of consolidation which would be more obvious if you dropped to a lower time frame once you find these bars.

BUY SELL LEVEL, INSIDE THE BAR, NR4, NR7, 100 DMA STRATEGY , CANDLESTICK PATTERN 05.02.2020

Eiffel Tower Guided Tour - 2nd floor + optional Summit access. 19. from $37.82. Likely to Sell Out. Paris, Île-de-France. Louvre Museum Paris Exclusive Guided Tour With Reserved Entry. 2,502. from $140.30. Price varies by group size.

NR7 Bar Scanner and Strategy Trading Fuel

NR7 with Inside Bar, Technical Analysis Scanner NR7 with Inside Bar New: LIVE Alerts now available! Scanner Guide Scan Examples Feedback Stock passes all of the below filters in futures segment: Bracket( Daily High - Daily Low ) Less than Bracket( 1 day ago High - 1 day ago Low ) Bracket( Daily High - Daily Low ) Less than Bracket( 2 days ago

Simple Tactics For Trading Narrow Range Bars NR4, NR7, NR4/ID Forex Training Group

Refining NR7 Strategy with Inside Bar Theory: NR7 functions as a method for generating a watchlist, offering various widely embraced approaches for handling stocks identified within the NR7 watchlist (pertaining to how, when, and what factors to consider for entry and exit decisions).

BUY SELL LEVELS, 100DMA STRATEGY,GMMA STRATEGY,INSIDE THE BAR,NR4,NR7,CANDLESTICK PATTERN 26.02.

Reverse of my own scan. Scanner that displays list of stocks that are expected to move exponentially, NR7 stocks along with Inside Bar pattern Technical & Fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc.

BUY SELL LEVEL, 100DMA STRATEGY, INSIDE THE BAR, NR4, NR7, CANDLESTICK PATTERN FOR 30.01.2020

Bear Signal Recap: Identify NR4 or NR7 day. Sell on move below low of narrow range day low. Set trailing stop-loss. Trading Example The trading example shows Morgan Stanley with twelve signals in less than three months. The blue arrows show the NR7 candlesticks and the thin blue lines mark the high-low of the range.

TODAY'S PERFORMANCE BUY SELL LEVEL, INSIDE THE BAR, NR4, NR7, CANDLESTICK PATTERN 23.01.2020

Small and intimate concert hall with a varied and high quality programme. There are tables, chairs and bar stools on the ground floor and tables and chairs on the mezzanine floor. Doors and bar open at 8.30 pm, concerts start at 9. A satisfying experience for music lovers who like intimate concerts.

How To Use The NR4 and NR7 Strategies Guide Keep Trading It

NR7 and Inside Bar Indicator. 1. We check if a candle meets both NR7 and IB conditions. If so, we set the color to sky blue (aqua). 2. If it only meets the NR7 condition, we set the color to blue. 3. If it only meets the IB condition, we set the color to yellow. 4.

Narrow Range (NR7) Inside Bar for NSEGODREJPROP by TrendwithMohit — TradingView

Volatility nr4 nr7 Inside Bar 1460 10 Indicator Script for identifying Narrow Range 4 / 7 + Inside Bar It also helps to check whether NR4 / NR7 breakout trading has been profitable or not in the past in a particular instrument. It has helped me to select profitable scripts and avoid losing ones. Can be used for anytime frame. SIGNAL

BUY SELL LEVEL, INSIDE THE BAR, NR4, NR7, 100 DMA STRATEGY, CANDLESTICK PATTERN 07.02.2020 YouTube

Scan Description: NR7 Inside Bar Setup - (Using Daily Chart Timeframe) 1. The bar following the NR4/ID bar must break above the NR4/ID bar. 2. Price must be above the 89 Period Simple Moving Average at breakout. 3. Buy above the high of the NR7 bar. 4.

7 Bar Patterns Every Stock Market Trader Should Know ELM

Scan Description: Narrow Range 7 plus latest one is inside bar Stock passes all of the below filters in futures segment: Daily High - Daily Low Less than 1 day ago High - 1 day ago Low Daily High - Daily Low Less than 2 days ago High - 2 days ago Low Daily High - Daily Low Less than 3 days ago High - 3 days ago Low Daily High - Daily Low